The US Bureau of Economic Analysis is due to report gross domestic product at 8:30 a.m. ET, and economists polled by Refinitiv are now projecting 2.1% annualized growth for the first quarter.

That would be only slightly lower than the previous quarter's 2.2% — which followed two robust quarters in mid-2018.

The US labor market has bounced back after disappointing data in February, and wages are growing faster than inflation. Consumer spending is recovering, and retail sales have rebounded after a slow start to 2019.

Perhaps the biggest factor underpinning market confidence: The Federal Reserve predicted that it might hold off on interest rate hikes for the rest of the year.

2. Amazon earnings: Amazon (AMZN) said Thursday that it made a record $3.6 billion in profit for the first three months of 2019, more than doubling from $1.6 billion in the year prior.

Amazon used to be known for bleeding money as it invested heavily in its businesses and rapidly increased revenue. Now it has entered a new era with comparatively sluggish sales growth, but consistent profits.

The increase in Amazon's profits is all the more remarkable given how it continues to pour money into fulfillment centers, premium video content, bricks and mortar stores and health care.

It's next big effort is super-fast deliveries. Amazon said Thursday that it plans to invest $800 million in the second quarter of 2019 toward making one-day shipping the standard offering of Prime.

3. Uber IPO: Uber is targeting a valuation of up to $90 billion in its initial public offering, according to media reports.

Uber filed paperwork to go public earlier this month in what is likely to be one of the biggest public offerings ever for a technology company. The listing follows an aggressive overhaul of the company's internal culture.

The tech firm plans to market shares to potential investors in a price range of about $44 to $50 each, according to Bloomberg. It could file documents with pricing details as soon as Friday.

4. What's next for Deutsche Bank? After ending merger talks with its rival Commerzbank on Thursday, Deutsche Bank (DB) has posted a 67% profit increase for the first quarter of 2019.

But revenue fell 9%, and the company said it would be "essentially flat" for the year. Its investment bank saw revenues slump 13%.

How will the German bank now address concerns over its ability to compete with US rivals? Investors aren't sure. Shares fell almost 3% in early trading in Frankfurt.

5. Global market overview: US stock futures were little changed.

In Europe, London's FTSE 100 opened in negative territory, while Paris' CAC 40 and Frankfurt's DAX posted small gains. Stocks in Asia closed mixed.

Sony (SNE) warned investors that its annual profit would drop in the 2019 fiscal year as sales of its aging PS4 console decline.

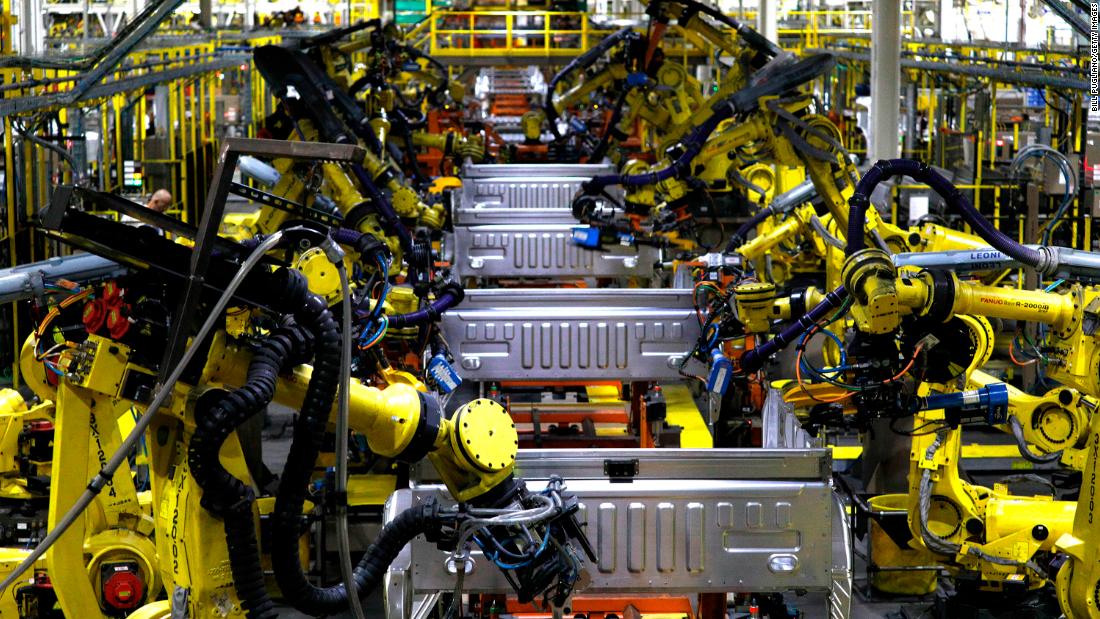

France's Renault (RNLSY) reported that its revenue dropped 4.8% in the first quarter. Global vehicle sales declined 5.6% to 908,348 after US sanctions forced the carmaker to shutter its operations in Iran.

American Airlines (AAL), Chevron (CVX), Exxon Mobil (XOM), Goodyear Tire (GT), IMAX (IMAX) and LendingTree (TREE) will release earnings before the open in New York.

The Dow closed down 0.5% on Thursday while the S&P 500 was little changed. The Nasdaq added 0.2% but fell just short of a fresh record close.

6. Coming this week:

Friday — US GDP; US consumer sentiment for April

Friday — US GDP; US consumer sentiment for April

Bagikan Berita Ini

0 Response to "US economic update; Amazon delivers; Uber IPO details"

Post a Comment